Best Gold IRA Companies Review: Quick Comparisons | |||||

|---|---|---|---|---|---|

Rank | Company | BBB Rating | Min. Investment | Pricing | More Info |

1 | A+ | $10,000 | Great: Up to10k Free Precious Metals | ||

2 | A+ | $10,000 | Clear pricing, Best price match guarantee | ||

3 | A+ | $2,000 | Transparent pricing, first-time buyer discount | ||

4 | A+ | $50,000 | Transparent Fee structures, Price match guarantee | ||

5 | A+ | $10,000 | Clear Fee Structures, No hidden charges | ||

6 | A+ | $25,000 | Fees depend on account size, No hidden charges | ||

Key Takeaways |

|---|

Birch Gold Group is renowned for its fee transparency, making it a trustworthy option |

Augusta Precious Metals comprehensive services and educational resources |

Noble Gold has a buy-back option and a wealth of educational resources |

American Hartford Gold offers the lowest fees, making it cost-effective for investors |

Advantage Gold is known for prioritizing customer needs |

Which Gold IRA Company is Best?

Birch Gold Group – Best for Fee Transparency and Low Minimum Investment

Due to their trustworthiness, here at prepsurvivalright.com Birch Gold is our in-house favorite, being a popular and credible choice famous for its fee transparency, as well as being endorsed by respected names like Ben Shapiro, Donald Trump Jr and Candace Owens.

Augusta Precious Metals – Best Overall Educational Resources

Augusta Precious Metals offers comprehensive services and robust educational resources, making it into the top choices for gold IRAs.

Noble – Best for Secure and Accessible Gold IRA Investments

Noble Gold is a favored choice due to its commitment to security, accessibility, and customer-focused services.

American Hartford Gold – Best for Low Fees

American Hartford Gold provides a cost-effective option with its low fee structure, ideal for budget-conscious investors.

Advantage Gold – Best for Customer Popularity

Advantage Gold is highly popular among customers, thanks to its commitment to prioritizing customer needs and offering a variety of precious metals products.

Best Gold IRA Companies Review: Smart Wealth Investment Choices

Investing in a Gold IRA is a strategic move to protect your wealth against inflation and diversify your investment portfolio. Among the many companies offering gold IRAs, five stand out as the best alternatives to Birch Gold: Augusta Precious Metals, Noble Gold, Goldco, American Hartford Gold, and Advantage Gold. Each of these companies has unique strengths that cater to different investor needs.

Choosing a Gold IRA Company: Which to Consider

When choosing a gold IRA company, it’s essential to consider factors such as reputation, fee transparency, customer service, and the range of services offered. The following companies excel in these areas, making them the top choices for gold IRAs.

Birch Gold Group – Fee Transparency & Low Minimum Investment

Birch Gold Group is a trusted company with over 20 years in modern gold investment practices. Advocated by ex-US Congressman Ron Paul and ex-US advisor Stephen Bannon, as well as well-known media figures like Ben Shapiro, Birch stands out as a well-researched and trusted gold IRA company due to its comprehensive precious metal investment strategies. Birch offers a range of precious metals, including gold, but also silver, platinum, and palladium.

-

- Birch Gold Group provides competitive fees and support.

-

- The setup process for their gold IRA is user-friendly.

-

- Transparency in costs helps investors make informed decisions.

Key Benefits Of A Birch Gold IRA

Birch Gold Group offers several advantages for investors considering a gold IRA. First, they provide personalized service. Dedicated Precious Metals Specialists assist customers in navigating the process.

Another benefit is the variety of investment options available. Investors can choose from a selection of IRS-approved gold and other precious metals. This flexibility allows for better portfolio diversification.

Birch Gold Group is also known for its educational resources. They offer comprehensive materials to help clients understand gold investment. This information can empower individuals to make informed decisions.

Additionally, the company has established a strong reputation. Birch Gold Group is recognized as a trusted provider in the precious metals market. Positive reviews underscore their commitment to customer satisfaction.

Furthermore, they offer competitive fees compared to other gold IRA companies. This helps clients maximize their investment without hidden costs or excessive charges.

Investors seeking gold IRAs might find the process daunting. Birch Gold Group simplifies the setup by working directly with clients. For anyone looking to secure their financial future, setting up a Gold IRA may be a wise step. With clear support and valuable insights, Birch Gold Group stands out among its peers.

For those contemplating gold investment, it’s essential to evaluate options carefully. Exploration of different companies can lead to better choices for individual needs.

Birch Gold Group Investment Strategies

Birch Gold Group offers a variety of strategies for investing in precious metals through a Gold IRA. This investment option allows individuals to diversify their retirement portfolios and hedge against market fluctuations.

Key Benefits of a Gold IRA:

-

- Tax Advantages: Like all IRAs, a Gold IRA provides tax benefits that can lead to increased retirement savings.

-

- Diversification: The inclusion of gold and silver can protect against stock market volatility.

Investors can select from a range of IRS-approved gold and silver coins. This allows them to tailor their investment according to their financial goals and risk tolerance.

Prominent Supporters:

-

- Ben Shapiro and Ron Paul have highlighted the importance of investing in physical assets like gold as a safeguard against inflation.

-

- Donald Trump Jr. has also expressed interest in precious metals, emphasizing their stability.

The process is straightforward. Customers begin by setting up an account with a custodian, followed by transferring funds from existing retirement accounts. Birch Gold Group provides resources and support throughout this process, ensuring clients make informed choices.

With Birch Gold Group, investors can explore various gold and silver products, benefiting from competitive prices and expert guidance. This combination makes it a valuable option for those prioritizing their retirement security.

Ease Of Setting Up A Birch Gold Group Gold IRA

Setting up a Gold IRA with Birch Gold Group is a straightforward process. They guide clients through each step, ensuring clarity and support.

The process typically involves five key steps:

- Account Setup: Start by opening an account with a trained Precious Metals Specialist.

- Funding: Choose a funding source, such as a direct transfer from an existing retirement account.

- Choosing Investments: Select IRS-approved gold and other precious metals for the IRA.

- Paperwork: Complete the necessary paperwork to comply with IRS regulations.

- Finalizing the Transfer: Complete the transfer of funds to finalize the setup.

Birch Gold Group emphasizes a smooth experience. Clients receive personalized assistance throughout the process. There are no surprise fees or complicated steps.

The company is known for its educational resources. They make it easy for clients to understand precious metal investments. Birch Gold Group also provides transparency about fees and requirements.

Their average customer review ratings reflect high satisfaction. With an A+ rating from the Better Business Bureau, they show a commitment to quality service.

Overall, setting up a Gold IRA with Birch Gold Group can be efficient and user-friendly, making it an appealing choice for investors.

Transparency Of Birch Gold Group Gold IRA Fees

Birch Gold Group emphasizes transparency regarding fees for their Gold IRA services. They detail their costs clearly on their website, allowing customers to understand what they are paying for.

Common Fees Associated with Birch Gold Group Gold IRAs (July 2024):

-

- Account Setup Fee: Approximately $50 for opening a Gold IRA account.

-

- Wire Transfer Fee: Around $30 for any wire transfers made to the account.

-

- Storage Fees: Costs depend on the amount of gold stored and range based on the storage facilities used.

-

- Insurance Fees: Clients may incur charges for insuring their precious metals.

Birch Gold Group aims to provide upfront information about these fees. This approach helps clients make informed decisions when investing in a Gold IRA.

Additionally, there are no hidden fees, which contributes to the overall trustworthiness of the company. Their commitment to transparency may appeal to individuals seeking to invest in gold as part of their retirement strategy.

By knowing the fee structure, investors can better plan their investments and understand the potential costs involved in maintaining their Gold IRA.

Augusta Precious Metals – Comprehensive Services

Augusta Precious Metals stands out amongst the best overall gold IRA companies due to its comprehensive services and robust educational resources. The company offers a wide range of precious metals, including gold, silver, platinum, and palladium, providing ample choices for diversification.

Comprehensive Services Offered

Augusta Precious Metals offers a full suite of services to meet the needs of its clients. These services include personalized investment advice, secure storage options, and assistance with setting up and managing gold IRAs. The company’s team of experts works closely with clients to ensure that they receive the support and guidance they need to make informed investment decisions.

Additionally, Augusta Precious Metals provides secure storage options for its clients’ precious metals. The company partners with reputable storage facilities to ensure that clients’ investments are safe and protected. This security is crucial for building trust and confidence among investors.

Customer Education and Resources

One of the key strengths of Augusta Precious Metals is its commitment to customer education. The company offers a wealth of educational resources, including articles, videos, and webinars, to help clients understand the benefits of investing in gold and other precious metals. This education empowers investors to make informed decisions and build a secure financial future.

Moreover, Augusta Precious Metals’ team of experts is always available to answer questions and provide guidance. This support can be particularly valuable for new investors who may need additional assistance to navigate the complexities of gold IRAs.

Noble Gold – Best for Secure and Accessible Gold IRA Investments

Noble Gold is a standout choice for gold IRA investments due to its commitment to security, accessibility, and customer-focused services. The company offers a comprehensive range of precious metals and ensures that clients receive personalized investment advice and secure storage solutions.

Security and Accessibility

Noble Gold prioritizes the security of its clients’ investments by partnering with reputable storage facilities. The company offers secure, segregated storage options through facilities such as the International Depository Services (IDS) in Texas and Delaware. This ensures that clients’ precious metals are safely stored and easily accessible when needed.

Additionally, Noble Gold provides clients with the ability to track their investments through a secure online platform. This transparency and accessibility help build trust and confidence among investors, knowing that their assets are protected and can be monitored at any time.

Personalized Services and Expertise

Noble Gold’s team of experts is dedicated to providing personalized investment advice tailored to each client’s financial goals. The company’s advisors work closely with clients to develop a customized investment strategy that aligns with their risk tolerance and retirement objectives.

Moreover, Noble Gold offers a variety of educational resources, including articles and guides on precious metals investing. These resources help clients understand the benefits of gold IRAs and make informed decisions. The company’s commitment to education empowers investors to take control of their financial future with confidence.

Positive Client Experiences

Clients consistently praise Noble Gold for its exceptional customer service and secure investment options. One client shared,

“Noble Gold made the process of setting up my gold IRA seamless and stress-free. Their team was knowledgeable and provided me with all the information I needed to feel confident in my investment.”

“Noble Gold made the process of setting up my gold IRA seamless and stress-free. Their team was knowledgeable and provided me with all the information I needed to feel confident in my investment.” https://www.noble-gold.com/testimonials/

This positive feedback highlights Noble Gold’s dedication to customer satisfaction and its ability to meet the needs of investors effectively.

American Hartford Gold – Best for Low Fees

-

- Low fee structure

-

- Wide range of precious metals

-

- Excellent customer service

-

- Flexible investment options

American Hartford Gold is known for its low fee structure, making it an attractive option for cost-conscious investors. The company offers a wide range of precious metals, including gold, silver, and platinum, providing ample choices for diversification.

Besides that, American Hartford Gold excels in customer service, ensuring that clients receive the support they need throughout the investment process. The company’s representatives are knowledgeable and responsive, making it easy for investors to get answers to their questions.

Additionally, American Hartford Gold offers flexible investment options, allowing clients to tailor their portfolios to their specific financial goals and risk tolerance. This flexibility makes it easier for investors to achieve their desired outcomes.

Fee Structure and Transparency

American Hartford Gold’s fee structure is straightforward and transparent. The company does not charge any hidden fees, which means investors can clearly understand the costs associated with their investments. This transparency is crucial for building trust and ensuring that clients feel confident in their investment decisions.

Moreover, the company’s low fees make it a cost-effective option for investors who want to maximize their returns. By keeping costs low, American Hartford Gold helps clients preserve more of their wealth, which is essential for long-term financial success.

Service Highlights and Benefits

American Hartford Gold offers several key benefits to its clients. First, the company provides a wide range of precious metals, allowing investors to diversify their portfolios effectively. This diversification can help reduce risk and enhance returns.

Second, the company’s excellent customer service ensures that clients receive the support they need throughout the investment process. This support can be particularly valuable for new investors who may have questions or need guidance.

Lastly, American Hartford Gold’s flexible investment options allow clients to tailor their portfolios to their specific financial goals and risk tolerance. This flexibility makes it easier for investors to achieve their desired outcomes and build a secure financial future.

Advantage Gold – Best for Customer Popularity

Advantage Gold has earned a reputation for its excellent customer service and comprehensive educational resources. This company is a favorite among investors due to its commitment to customer satisfaction and transparent fee structure.

What Sets Advantage Gold Apart

-

- Wide range of precious metals products

-

- Personalized investment advice

-

- Clear and competitive fee structure

-

- Exceptional customer service

Advantage Gold offers a comprehensive selection of precious metals, including gold, silver, platinum, and palladium. This variety allows investors to diversify their portfolios according to their preferences and risk tolerance.

The company’s team of experts provides personalized investment advice, ensuring that each client receives tailored guidance based on their financial goals. This level of personalized service sets Advantage Gold apart from many competitors.

Advantage Gold’s fee structure is transparent and competitive. There are no hidden charges, which means investors can make informed decisions without worrying about unexpected costs. This transparency builds trust and confidence among clients.

Moreover, Advantage Gold is known for its exceptional customer service. The company’s representatives are always available to answer questions and provide support, making the investment process smooth and stress-free.

Customer Testimonials and Reviews

Customers consistently praise Advantage Gold for its outstanding service and knowledgeable staff. One customer noted,

“Advantage Gold made the process of setting up my gold IRA simple and straightforward. Their team was always available to answer my questions and provide guidance.”

This positive feedback reflects the company’s commitment to customer satisfaction and its ability to meet the needs of investors effectively.

Factors to Consider When Choosing a Gold IRA Company

When selecting a gold IRA company, several factors should be considered to ensure you make the best choice for your investment needs. These factors include reputation, fee transparency, customer service, and the range of services offered.

Reputation and Trustworthiness

It’s crucial to choose a gold IRA company with a strong reputation and a track record of trustworthiness. Look for companies with positive customer reviews and high ratings from reputable sources. This can help ensure that you are working with a reliable and reputable company.

Transparent Fee Structures

Fee transparency is essential when choosing a gold IRA company. Ensure that the company provides clear and detailed information about all fees associated with your investment. This transparency can help you avoid unexpected costs and make informed decisions.

Range of Services Offered

Consider the range of services offered by the gold IRA company. Look for companies that provide comprehensive services, including personalized investment advice, secure storage options, and assistance with setting up and managing your gold IRA. This can help ensure that you receive the support and guidance you need throughout the investment process.

Gold IRA Pros and Cons

Investing in a Gold IRA offers several benefits that can help protect and grow your wealth over time. These benefits include protection against inflation, diversification of your investment portfolio, and long-term wealth preservation.

Pros

Protection Against Inflation

Gold has historically been a reliable hedge against inflation. By investing in a Gold IRA, you can protect your retirement savings from the eroding effects of inflation and maintain your purchasing power over time.

Diversification of Investment Portfolio

Adding gold to your investment portfolio can help diversify your holdings and reduce risk. Gold often performs well during economic downturns, providing a stable and secure investment option that can balance out the volatility of traditional assets.

Long-term Wealth Preservation

Gold has maintained its value over time, making it an excellent choice for long-term wealth preservation. By investing in a Gold IRA, you can ensure that your retirement savings remain secure and continue to grow over the years.

-

- Protection against inflation

-

- Diversification of investment portfolio

-

- Long-term wealth preservation

Cons

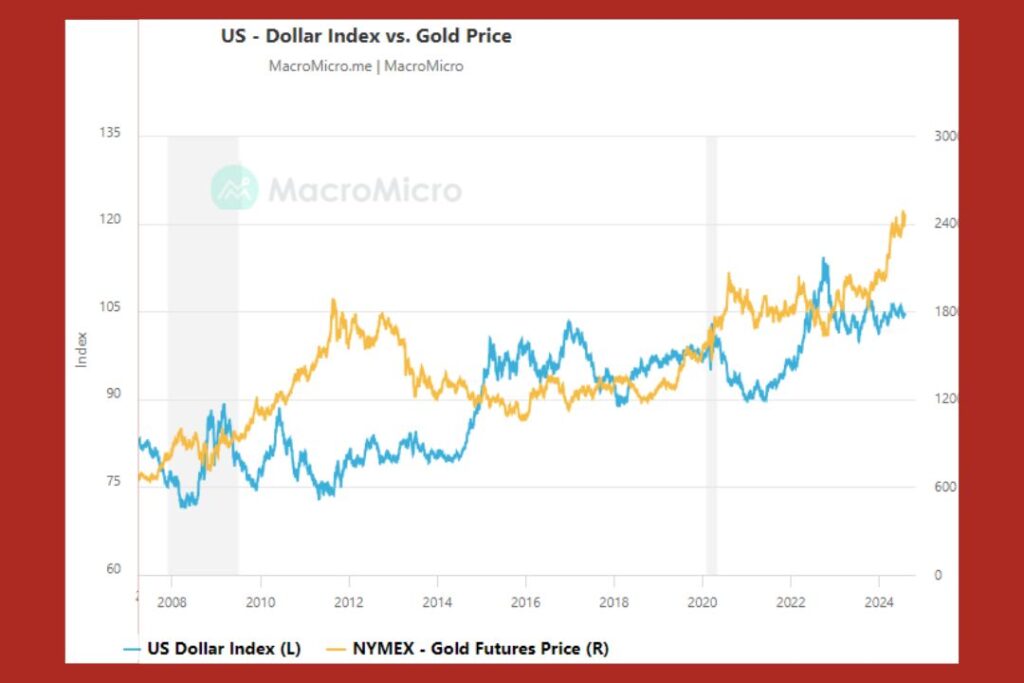

Risk: Like any investment, the value of gold, or it’s growth against inflation, is not guaranteed. Historically gold has performed well when currency markets have floundered in times of financial and political uncertainty (as can be seen in the chart below) which is why many investors diversify their portfolios into gold, including for retirement plans.

Storage Fees: The current conditions of a gold IRA include that it must be physical gold stored in a secure deposit through an authorized custodian. Typically these authorized custodians have annual storage fees, so you should factor the fees into your overall costings. For example, at the time of writing, Birch Gold charges an annual fee of $100 for storage, which includes insurance.

Frequently Asked Questions

How do I start a Gold IRA?

To start a Gold IRA, you’ll need to choose a reputable gold IRA company, open an account, and fund it with either a rollover from an existing retirement account or a new contribution. The company will then help you purchase and store the gold.

Are there any risks associated with Gold IRAs?

Like any investment, Gold IRAs come with risks. The value of gold can fluctuate, and there may be fees associated with purchasing, storing, and managing the gold. However, gold is generally considered a stable and secure investment.

Can I transfer an existing IRA to a Gold IRA?

Yes, you can transfer an existing IRA to a Gold IRA through a process called a rollover. Your gold IRA company can help you with this process to ensure it is done correctly and without any tax penalties.

What are the tax implications of a Gold IRA?

Gold IRAs have similar tax implications to traditional IRAs. Contributions may be tax-deductible, and earnings grow tax-deferred until you withdraw them in retirement. However, early withdrawals may be subject to taxes and penalties.

How can I get a free starter kit?

Many gold IRA companies offer free starter kits to help you learn more about investing in gold. You can request a Birch Gold starter kit from the company’s website and it is the sae for other companies too, or by contacting their customer service team.

Investing in a Gold IRA is a smart way to protect your wealth and ensure a secure financial future. By choosing a reputable gold IRA company and understanding the benefits and risks, you can make informed decisions and achieve financial freedom confidently.